Maybe you have reached a stage in your life where you’ve encountered a major financial decision and don’t know where to turn. Do you ask your uncle’s friend’s sister who’s a financial advisor for help? Do you post on Facebook asking for advice? Does your google search confuse you further by the myriad of diverse and seemingly contradicting answers?

The truth is, good financial advice is hard to find. There are many companies and people who benefit from you not knowing the best course of action! It’s no wonder that banks set up booths at college graduations offering loans, credit cards, etc. How, then, do you find the best advice for YOUR needs, and make sure the advice given is in your best interest?

The first step is discerning what type of financial advisor you need. Do you need advice on loans for a home? Or how about buying vs. leasing? Do you need information on how to best save for retirement, college expenses, etc.? What about managing debt and consolidating loans? Do you have enough insurance, or how about choosing the best benefits offered through your employer? As you can see, all of these constitute financial advice, but span a wide area of expertise. For the purposes of this post, we’ll focus on navigating investment-related financial advice. This could encompass retirement, college savings, how to invest your excess funds, etc.

As chronicled in a previous post , anyone can call themselves a financial advisor. The government does little to regulate who can call themselves what, but there are two distinctions they DO provide: Broker vs. Investment Adviser. Keep in mind, both can call themselves a financial advisor or a financial planner, but I’ll start with showing you how to determine who’s who, and what that means to you.

BrokerCheck®

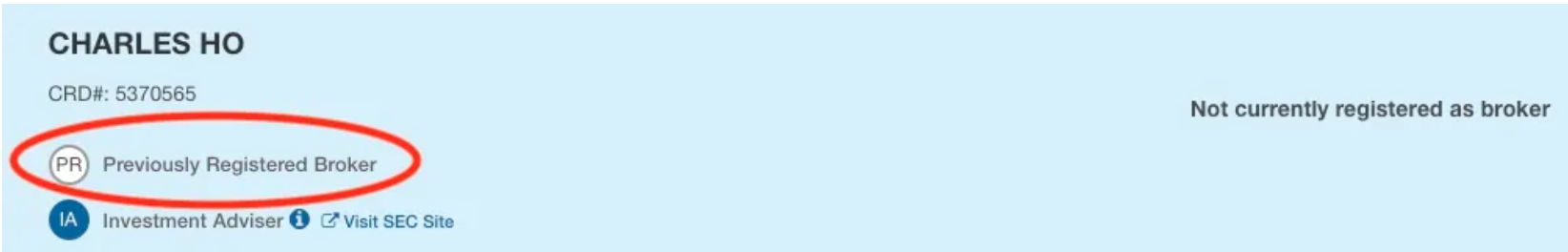

The first step in looking up a Financial Advisor is to search for them using FINRA’s BrokerCheck® tool. FINRA, which stands for Financial Industry Regulatory Authority, is overseen by the SEC (Securities Exchange Commission), which is an independent agency of the federal government. FINRA’s mission is to protect individual investors by making sure investment firms operate fairly and honestly. FINRA regulates brokers. They also strive to educate investors, and offer their BrokerCheck® tool to help investors research the background, experience, complaint history, etc. of financial advisors. You can head over to BrokerCheck® or go to https://brokercheck.finra.org and enter the name of a financial advisor you are looking into. Here is mine, for example!

There are a few important pieces of information on this page I wanted to go over. The first bit is right on the top:

Here, you can see that I was previously registered as a Broker. If you search for a Financial Advisor, and they are listed as a Broker, beware! I will touch on this more later.

Further down from this, you will see employment history and exam history. This is important to know whether or not the Financial Advisor you are looking into has only been in the business for a month! I’m not one to say someone who is new is necessarily bad, but depending on the complexity of what you’re seeking financial advice about, you may want someone who has some experience under their belt and has run across similar situations in the past.

Lastly, there is an option ABOVE the name of the individual to download a Detailed Report. This has much of the same information, but it also lists Disclosure Events (if any). These can be anything from bankruptcy, short sales, etc. to customer complaints. If there is a customer complaint, you will be able to see details on what the complaint was, and what the resolution was. This is a good place to see if a Financial Advisor has done some unethical things in the past!

IAPD

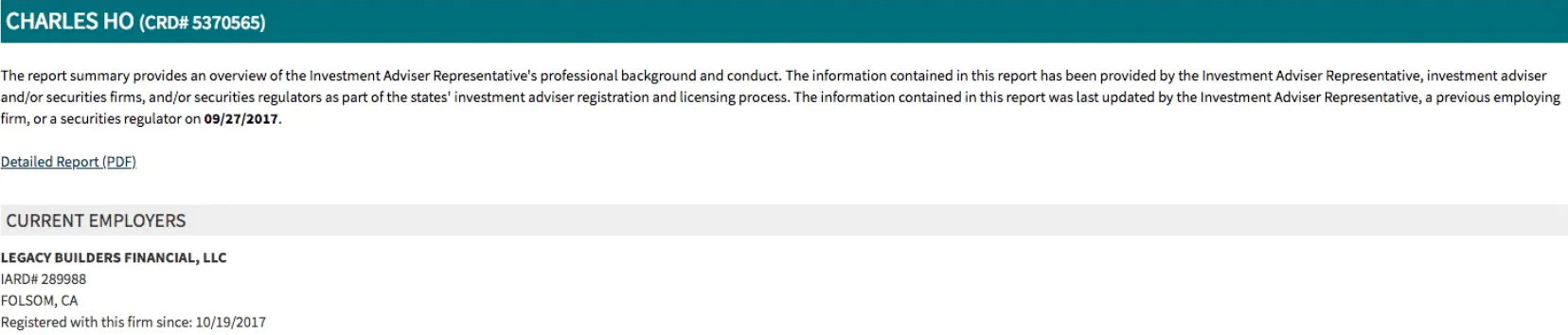

Now what, if your Financial Advisor isn’t listed on BrokerCheck®? Or in my case, I’m listed as an Investment Adviser? You can click on the link in BrokerCheck® to automatically be directed to the SEC’s IAPD website, or go here. IAPD is the Investment Adviser Public Disclosure, which EVERY investment adviser has to have. This page is going to have similar information as FINRA, but there’s something else that’s important here: Firms have to have an IAPD! If you look up my IAPD, you will see this:

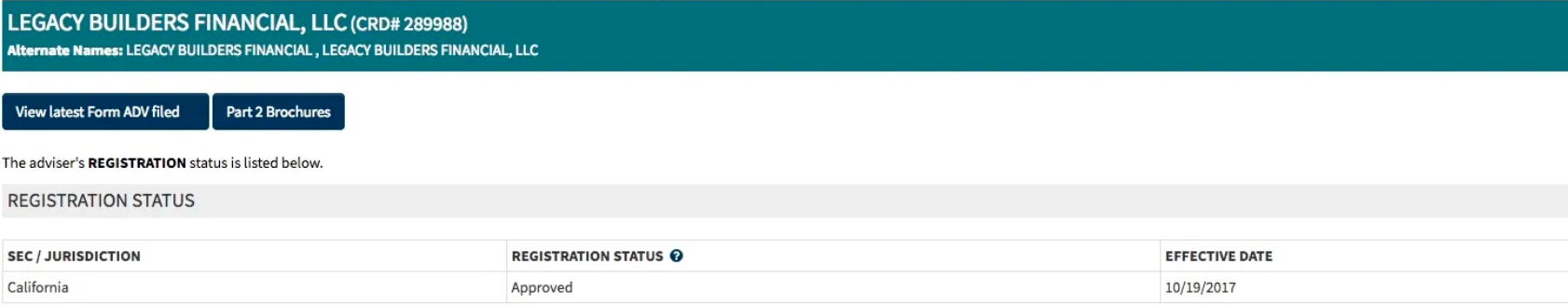

This is my individual IAPD. If you were to take my current employer and search, you would come up with this:

Here, you can see some basic information about my firm. The meat of the information is found by clicking on Part 2 Brochures. Every investment advisory firm is required to publish and update their Form ADV Part 2. This form details how an investment advisory firm runs its business, what services it provides, how they charge fees, etc. This is a GREAT place to see how your financial advisor’s firm gets paid! You’ll be able to see who works for their firm and their history, any disciplinary action taken against the firm, and whether the firm holds to a fiduciary standard, which I will touch on shortly!

So What’s the Difference?

So now you’ve looked up your uncle’s friend’s sister and have determined they’re either a broker or an investment advisor. What’s the difference between the two? In short, the SEC makes the distinction that brokers are intermediaries. They make the connection between an individual investor and an investment product. An investment advisor, per the SEC, is someone who assists an individual in making financial decisions pertaining to retirement planning, college education, developing investment strategies, etc. The biggest distinction that pertains to you, the consumer, is this: Brokers are held to a Suitability standard, while Investment Advisors are held to a Fiduciary standard.

The suitability standard simply means the broker has to ensure their recommendation meets the financial needs, objectives, and circumstances of the client. This means if you are an investor looking to invest in international stocks, the broker can fulfill his suitability requirement by recommending a mutual fund with a high commission that fits your needs, even if there is a different mutual fund that better benefits you (the client) but offers a lower commission to them/their firm. The suitability standard means the broker’s loyalty is to their firm first before the client.

The fiduciary standard means an advisor must place his or her interests below that of a client. Their loyalty is to the client first, not the advisor or their firm. If we use the same scenario above, this means the advisor must find, within reason, the mutual fund investment that is best for the client, regardless of how it impacts his/her own pay. The fiduciary standard is monitored through complaints, which is why it’s so important to check those reports before choosing an advisor. This means if you are shopping around for an advisor, you want to make sure they have it in WRITING that they function as a fiduciary. This can be found in a firm’s ADV Part 2, amongst other places.

I cannot tell you how many times I have met with clients who have been burned in the past by unethical advisors. Please, please, please do your research before choosing who to trust with your finances! Be sure the person you hire has your best interest as their highest priority, not their own!

I am part of several organizations that require I uphold my fiduciary commitment. I pride myself on truly putting my clients first! I would be honored if you would trust me to help you build a financial legacy for you and your family. Click here to learn more about me!

We look at reviews and do research when buying anything these days. Even silly things like baby bottles or a pair of socks, am I right? Hopefully after reading this article, you will be equipped to do some research before hiring a financial advisor and in turn, make a more informed choice. Also, you see the reasons why choosing a Fiduciary is to your benefit in the long run.

To recap our steps, first, decide what type of help you need; a Broker or an Investment Advisor. Next, use these online resources I mentioned to learn more about the background and credibility of potential advisors. You don’t want to trust just anyone with making YOUR financial decisions without making sure they have YOUR best interest in mind. Follow these two steps and streamline your path to finding a financial advisor that fits your needs.