Have you had years that the market has performed extremely well, yet your portfolio has not matched the market’s return? Have you wondered if your investment portfolio is right for you? Have you wondered if your portfolio’s risk tolerance is appropriate? If so, read on.

When creating an investment portfolio, the most important thing to understand is YOURSELF. You read that right- even more important than understanding the market is your understanding of yourself. You need to be honest with yourself about the level of risk you are willing to take with your money. Don’t get distracted by the market’s performance and lose sight of your own risk tolerance.

What is Risk Tolerance?

Risk tolerance is simply how much of a gamble you’re willing to take with your money. You should have a realistic understanding of your willingness to stomach large swings in the value of your investments. If you take on too much risk, you might panic and sell at the wrong time.

Risk tolerance changes from person to person (and even over time) but understanding your risk tolerance is integral in having a successful investment plan. Once you know your risk tolerance, you are one step closer to creating the best portfolio.

If you want help evaluating your risk tolerance, contact me here to discuss!

The Goal of Your Portfolio

It is important to understand that portfolios are built to match an expected return based on the amount of risk you’re willing to take, NOT to try to beat the market. It’s common (and not at all advised) to jump from one “hot” investment strategy to the next.

I recently had a conversation with a friend who expressed frustration with a robo-advisor he had been using, as he was disappointed by its performance. In his words, “my portfolio was only up 13% while the market was up over 20%.” You may have felt a similar way, and possibly even fired an advisor because your investments underperformed compared to the market.

Beware of comparing your portfolio’s performance to the market. Instead, ensure your portfolio is appropriately diversified according to (at the minimum) these 5 asset classes:

- Large US stocks

- Small US stocks

- International stocks

- Fixed Income (Bonds)

- Cash

How are Portfolios Built?

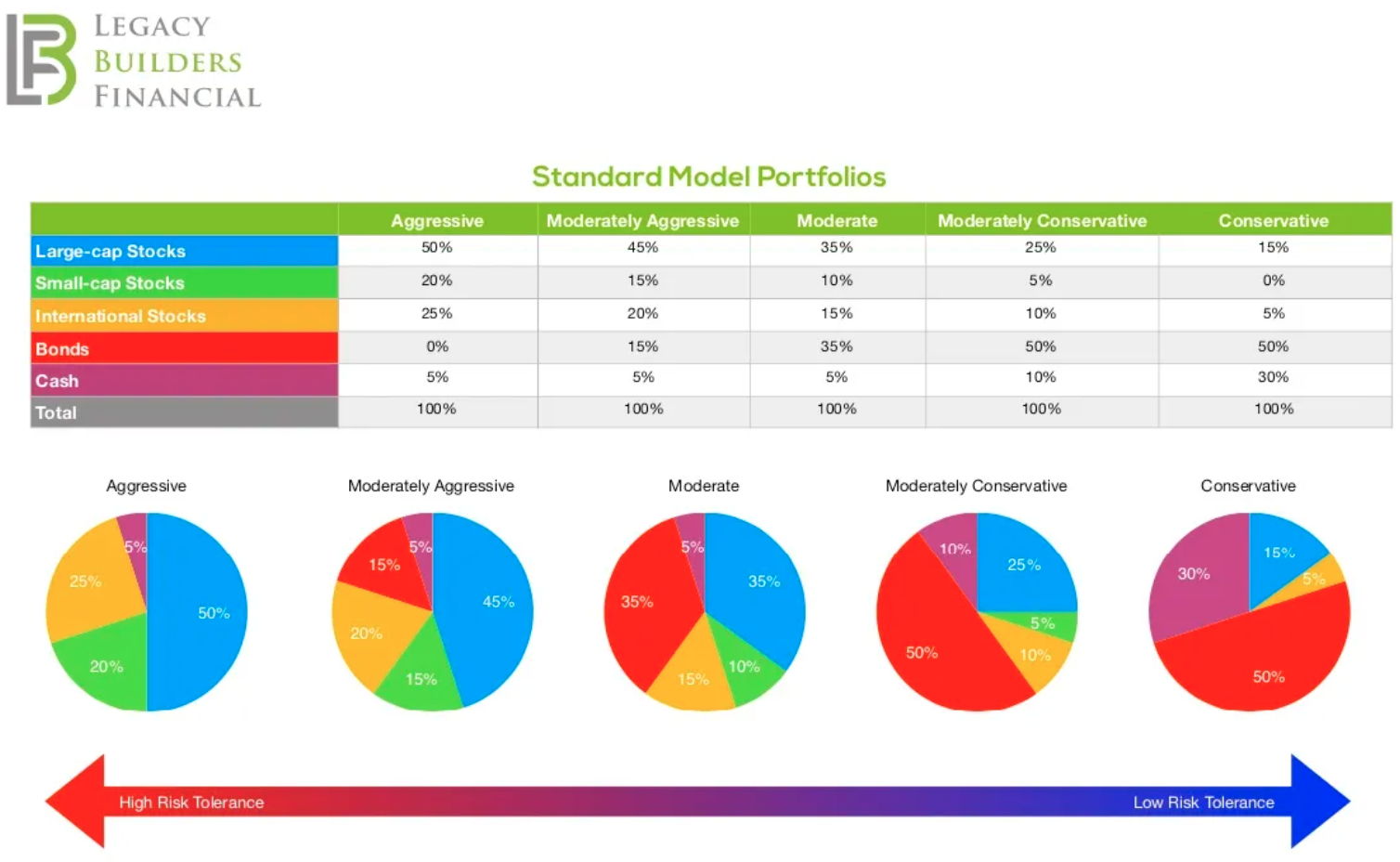

At the basic level, portfolios are constructed with a percentage of the portfolio invested in each of the 5 asset classes above. Someone who is more aggressive will have a higher percentage of their portfolio made up of stocks and have little in the way of bonds and cash. Someone who is more conservative, might be the opposite. Here’s a set of standard model portfolios using the same asset classes above:

As you can see, your level of risk tolerance impacts the way in which your portfolio should be diversified amongst asset classes.

Would You Sell?

In 2008 the market went down 37%. Can you imagine if your portfolio matched the market? Would you be able to stomach a 37% loss of all your investments? For most people, a loss of 37% of their portfolio value would be catastrophic! Many would not be able to sleep and would contemplate selling out of the market. The danger of selling in times like these is you miss the rebound! The very next year (2009), the market went UP 26.5%. And those who were able to hang on fully recovered from the 37% drop in only two and a half years!

By investing in a portfolio that matches your risk tolerance and objectives, you are significantly more likely to stay invested through good and bad times. By staying the course, an investor is more likely to participate in market returns and be able to sleep at night. Again, the key to staying the course is understanding your level of risk tolerance and then having your portfolio invested in asset classes that mirror your level of risk.

It seems silly to compare the performance of your portfolio based on the market when we know the facts, doesn’t it?

As always, I’m here to help! Please post comments or contact me directly if you have any questions! If you would like to analyze your portfolio on your own to see where you are, check out this free tool!