In my previous blog post, I mentioned there is no pre-qualification to call yourself a Financial Advisor. The truth is, anyone can apply the title to themselves, which is why you must make yourself aware of who you are working with. Many people who call themselves Financial Advisors are essentially salespeople. You will want to distinguish who is looking out for your best interest vs. someone who is trying to sell you something.

You may say, “Charles, everyone has to earn a living. As long as what they’re doing is beneficial to me, I don’t mind them earning a buck.” While that may be true, the issue is whether there is a conflict of interest. If an advisor can choose between two investment products, you want him/her to recommend the one that is the best fit for you. If one product pays the advisor a better commission, it may cause the advisor to choose that product, even if it’s not the best fit.

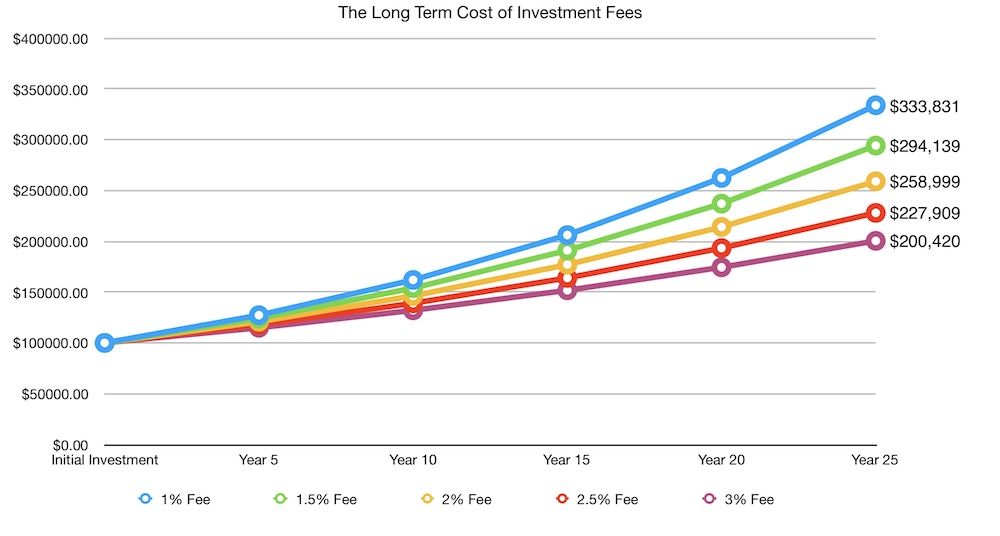

I created a chart to help illustrate how this can affect your portfolio over time:

In this chart, each line represents an investor who invested $100,000. Each investor has an investment that charges a certain percentage. Over a span of 25 years, you can see how much the charge eats into the potential growth.

In fact, even 0.5% of a difference can cost an investor over $40,000 and that’s WITHOUT putting in any extra money!

There are many different ways advisors can charge higher fees and hide them, but that’s for another blog post. One simple way to protect yourself though, is to ask if your financial advisor is a fiduciary. This means they must avoid conflicts of interests and operate with full transparency. It’s not a slam-dunk to finding a good advisor, but it should help weed out the bad!

Stay tuned for upcoming blog posts where I will go over some different investments that have high hidden fees. In case you are wondering, I AM a fiduciary. If you’d like to learn more about me, click HERE. You can also make an appointment with me directly HERE.